Why companies struggle to innovate and why they should focus on repurposing ideas instead of trying to reinvent the wheel.

Unlike many Data Scientists, I don’t have a PhD in Math, Statistics or Computer Science, I don’t even have a PhD for that matter. I believe that is the main reason why I don’t get stuck on complex algorithms and endlessly debate about which one of them would potentially solve a problem, as I see so many Data Scientist do. I tend to look at things from a business perspective and focus on what the desired outcome has to be, before diving into a pile of data and figuring out what type of algorithms could solve my problem.

From a very young age I was always entrepreneurial, from starting a gardening service in my neighborhood, washing cars or selling post stamps door-to-door. But unlike most of the great entrepreneurial stories you hear, I didn’t flip that into a multi-million dollar enterprise, most of my endeavours’ were very specific and short-term. Anything from wanting to buy candy, a new bike or some new clothes. Luckily as I continue to get older, I realized that delaying gratification is much more rewarding both professionally and financially.

But in my work understanding the big picture and being able to break it down in to smaller short term objectives has served me well. This is why I am stunned at so my companies, who want to be seen as the most innovative company, a disrupter, but don’t understand that to be truly disruptive you don’t have to re-invent the wheel.

Innovation vs. Increase Effectiveness

Like most people I love innovation, in the past I would have been one of the people waiting in line or pre-ordering the latest game console, smartphone or wearable, lately I tend to be a little bit more skeptical about what is considered innovation and what is in essence repurposing an old idea to a new scenario/industry/process.

When Apple came out with the Apple-I, it created a truly innovative product, which led to competition from IBM, Compaq and later Dell, who didn’t necessarily innovated but focused on developing more effective and cheaper approaches to produce personal computers for the masses.

Within my field of expertise, Payments, I am experiencing the same thing. Companies who are claiming to be extremely innovative, but are essentially only increasing the effectiveness of the process.

To give an example, today there are over 900 different Payment Service Providers, each one of them provides merchants with the ability to process transactions over the rails of card networks like Mastercard, Visa, JCB, Diners/Discover and UnionPay. Rather than focussing on finding a new way to exchange value among merchants and consumers, PSPs focus on expanding connectivity and capabilities and call it innovation. Integrating with hundreds of Alternative Payment Methods, or reducing friction by building multiple parts of the Payments Value Chain into one platform, is very challenging and provides significant value to global merchants, but it isn’t until the majority of PSPs understand that processing payments is a commodity, they will start to explore how to innovate to create actual value.

Sidenote: You might be thinking, but isn’t that what Cryptocurrency is doing, and you are right, but unlike the large card networks, Cryptocurrencies sit outside of what the world as a whole considers monetary value. So until Cryptocurrencies are considered a globally accepted currency, like the Euro, the Dollar or the British Pound, I tend to leave them out of my analysis. That does not mean that I don’t believe that the technologies that are powering the Cryptocurrencies, hold the most potential truly disrupt the global economic system.

Repurposing ideas

As I discussed in previous post, I believe that the opportunity in the Payments space and every other industry that relies on technology, is to add-value through the usage of Data.

Besides trying to change the technology or increase the effectiveness of a process, companies should also be focussing on how they can leverage the data in their possession and use non-industry related concepts and algorithms to provide real value to their customers by showing them insights, optimizing performance and reducing costs.

Of course there are many more applications for data, but when you are just trying to figure out, how you can leverage the data that you have, finding insights, optimizing performance and reducing costs are the three things that are easiest to achieve and have a great positive impact on the business.

Insights

No matter the industry that you are in, retail, transportation, financial services or any other, the one question that continues to come up is: “What do we know, that our customer, competitor or supplier does not know?”. The question might be asked in a ton of different ways, but it always comes down to the insights that you have that others don’t and how you can benefit from it.

In Retail, if you know what kind of clothing your shoppers have bought in the past, you can make better estimations on what to buy for the upcoming season. In Transportation, if you know during which times there is increased traffic on certain roads, you can suggest alternative instructions to your drivers to reduce the travel time. In Financial Services, if you understand the spending habits of your clients, you are able to provide them with offers for credit cards that could help them earn rewards for when they travel abroad or at specific retailers.

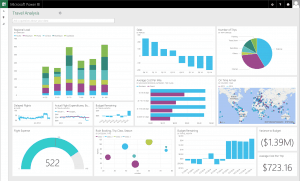

Being able to use the data that you have in your possession and provide your employees with Business Intelligence to make evidence-based decisions as well as customers with insights into their interaction with your company, is the first step in providing value and enhancing your overall product/service.

Looking at platforms like Google Analytics or Kiss Metrics, we see how getting insights from data can help us to make better decisions over time. Even better when we can use the insights to automate the decisions we make somewhere else, like for instance which ads to run and based on what keywords.

By repurposing these same ideas, we could improve the way we look at data across all industries. Retail could use a combination of sensors, motion and register data, to track the number of people walking into a location, the way shoppers move through the store and eventually how many end up buying something. This would not be very different from the way Google Analytics uses clickstream data to track how shoppers interact on your website and connecting it with e-commerce checkout data to determine which shoppers actual end up buying something.

Optimizing Performance

Another way of leveraging the data that is generated within your company, is to improve the performance of your product. Especially in Technology, the number one reason for companies to become obsolete, is because they build something that solved a problem better than a previous incumbent, but haven’t reinvested in improving the product ever since. As more customers were using the product, they have worked on ensuring that the process is as efficient as possible, but making actual adjustments has become to big of a risk.

Unlike Insights, Optimizing Performance should not be an analysis process but an automated process through the use of algorithms. By determining the Key Performance Indicators (KPI’s)that are crucial for the company, creating processes to optimize for those KPI’s should be the next step after building Business Intelligence.

In Transportation, especially in the delivery of perishables every unnecessary minute spend out on the road instead of in a warehouse or at the grocery store, should be eliminated. So let’s imagine a truck driver who has to deliver goods to five different locations. Instead of going down a random list, we would use an algorithm to calculate the shortest path, based on the distance/time.

In a perfect world there would never be a problem and this calculation would be done once and never has to be done again. But with changing weather conditions, traffic and road work, the path needs to be recalculated every single time to ensure that the route chosen is the best one. By using historical data as well as third-party data, an algorithm could optimize the performance for every delivery to ensure that each day the best route is chosen.

Reducing Costs

Another often overlooked way to leverage data is to reduce cost, the reason it is mostly overlooked is because the resources and time spend on trying to save 1% are much rather used on trying to increase sales or revenues. But especially in the Financial Services industry, reducing costs has been a very big focus point since the rise of FinTech and the unbundling of the banking industry.

Challenger banks are reducing the cost of maintaining a bank account, because they don’t need expensive retail locations. Payments companies are dealing with increased competitions and Full-Stack PSPs, who can operate on thinner margins by integrating multiple parts of the value chain. And even Lending has had to deal with Alternative Lending companies who reduce the risk and fees by using crowd-funding and being fully digital.

So where Business Intelligence provides companies with insight into the underlying trends of the business, and algorithms help to improve operational performance, joining the two together and quantifying the impact in the cost reduction is what provides value to both the company and it’s clients.

In Payments processing transactions is more frequently done through multiple Acquirers, who each maintain a different pricing structure. By tracking the performance of each connection and the cost associated to it, PSPs could leverage the insight to help their merchants route transactions to the best performing or lowest priced route.

Low hanging fruits vs. Moonshots

Whenever we think about great innovator’s like Steve Jobs or Elon Musk, we tend to believe they are constantly shooting for the moon, which couldn’t be farther from the truth. Like a Thomas Edison, Nikola Tesla, The Wright Brothers, Alan Turing or Tim Berners-Lee, true innovation is not about the giant leap, but about the small steps accumulated which nobody sees that compounded shift a paradigm.

By focusing on the low hanging fruits by creating better insights for your employees/colleagues, using state-of-the-art technologies to implement algorithms that optimize performance and by reducing costs as well as improve the underlying processes, companies can make those small steps that over a period of many years compounded look like great innovation.