How Algorithms are going to change the Payments Industry

It wasn’t so long ago that CEO’s and large banks were convinced that bank locations would always be necessary to service their customers. However the last ten years we have seen an emergence of Digital Banks, that have never and will probably never own a physical location, but still manage to grow their user base and add additional services including insurance, mortgages and loans.

In the Payments industry we have seen companies like Chase and First Data dominate for well over forty years. However just like the digitization of banking has forced incumbents to change their strategies, the digitization of payments has provided companies like WorldPay, Vantiv and lately even Stripe, PayPal/Braintree and Adyen to take up much of the market share, not by focusing on traditional businesses, but by focusing on startups who have grown to overshadow and sometimes even bankrupt traditional businesses. Think of Blockbuster versus Netflix, Taxi’s versus Uber or Traditional Stores versus Amazon.

But as more and more businesses are understanding that digital is the new traditional, I often get the question what’s next for the payments industry?

Just like the companies who were open to adopting computers and databases in the 1970’s and 1980’s, or the companies who understood that the internet would be a game changer back in the 1990’s and after the Dotcom-bubble burst in the 2000’s, I believe that the companies who understand that algorithmization is going to change industries and are actively investing in it, are most likely to come out of the 2010’s and 2020’s as survivors.

Digitization of Processes

To understand what Algorithmization is, we need to take two steps back to traditional business processes. For hundreds of years, traditional business processes, consist out of the labour of people creating products or providing services and the supporting business processes that accompanied them.

For example, a doctor providing medical services would have office hours, where patients would walk in or make an appointment. Traditionally the process of registering patients, updating their files or writing a prescription would all be done by hand written on paper. With the digitization of these processes, computers entered the doctor’s office, files were stored digitally, appointments were made in a digital calendar and prescriptions were emailed to the pharmacist.

Even till this day businesses are still improving the digitization of processes, by developing mobile apps or providing customers with cloud-based solutions to better access or store the data that are derived from the actual business processes.

Algorithmization

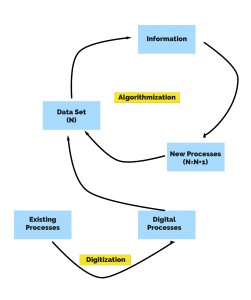

When we talk about Algorithmization, we talk about the process of using digitized labelled data which is stored as a data set in a database, and using automated processes to create analytics from which users can derive information. A process that most companies have already went through but which is only the first steps into Algorithmization. Whenever a Data Set (N) can be used to create analytics from which users are deriving information, the next step is to use Machine Learning and Artificial Intelligence to create a New Process (N=N+1), which in itself provides a new Data Set completing the Algorithmization cycle.

A Payment Service Provider Example

To illustrate, imagine a Payment Service Provider who processes millions of transactions a day. Each transaction that is submitted by a merchant contains transaction related information like a PAN (Personal Account Number), CVC (Card Verification Code), Expiry Date and Customer Name and E-mail Address. Through the browser, the PSP is able to collect additional data like the date and time, device fingerprint, Browser-type and Version, IP-Address and some other data points (N).

As the transactions are being processed they are stored in a database. Most PSPs will use this data to provide their Merchants with a standard report of the transactions of a particular day. Some might even go as far as aggregating the data to provide a summary of the data. If they want to be really fancy, they develop dashboards and graphs that are accessible through a UI, to show how transactions are progressing over time.

With the advancements in computing power, cloud computing and distributed storage technology, a lot of companies including PSPs have been experimenting with ways to improve existing processes. So for example the herefore mentioned PSP could decide to research if the large set of historical data could help them prevent fraud on incoming transactions. By using Machine Learning and Artificial Intelligence, data scientists could create an algorithm that is able to use the many variables that are part of a transactions and predict the likelihood of a newly submitted transaction to be fraudulent.

The great thing about card-based payments, is that cardholders are able to dispute transactions for a specific period of time. Whenever a fraudulent transaction has been reported, the issuer sends a message to the scheme to chargeback a transaction. Whenever the PSP receives this information, they are then able to store that in their database as well. This gives them the ability to learn the accuracy of their initial prediction. By using Artificial Intelligence, they could adapt the original algorithm to improve the scoring by increasing or decreasing the weights that are placed on the variables taken into account of the algorithm, in effect creating a new process (N=N+1).

How will Algorithmization affect Payments?

The example above was just one use-case of how Algorithmization could be used to improve existing processes, the funny thing about the example above, is that this has been the way most fraud solutions have been dealing with the issue for many years, however fraudsters have become smarter as well, which means that fraud still happens.

But Payments is far more than just preventing fraud. Costs, conversion, connectivity, billing and payouts are some of the areas where new PSPs are able to use Algorithmization to make a difference. As more and more companies are getting used to the commoditization of PSPs, the only way to stay successful as PSP is not by focusing on reducing fraud or driving down the cost of each transaction, but by showing the value of a PSP that is able to generate you more business.

The reason why sales people are celebrated more than the finance department, is because generating more revenue equals growth, where as reducing costs might improve profits but does not increase revenue.

Intelligent Acquiring Routing

The same transactional data can be used to optimize the acquiring route based on performance, functionality or pricing. A great way is implementing a multi-armed bandit algorithm, which is a ’smarter’ or more complex version of A/B testing that uses machine learning algorithms to dynamically allocate traffic to variations that are performing well, while allocating less traffic to variations that are underperforming. By connecting multiple acquirers, PSPs can improve their merchants results by routing transactions to the acquirer that provides them the best result for that merchant, best being performance, pricing or functionality.

Dynamic 3D Secure

With additional two-step verification measures like Verified by Visa or 3DSecure from Mastercard, a lot of PSPs are still seeing high decline rates due to issuers mandating two-step verification transactions. By using Decision Tree Learning, PSPs could predict if a transaction needs to be routed to a 3DSecure page for the additional two-step verification or if proceeding to the traditional flow will lead to a successful transaction.

Don’t be limited by other people’s imagination

Of course there are many other ways of using the transactional data that is available in payments to improve merchant performance. It will be the PSPs that are able to take the same data that has been generated for decades and think how they can improve processes by using the tools available to them today, to create a PSP that is better suited for merchants and business models that don’t even exist yet.